Strategic fiscal and monetary interactions in the Brazilian economy

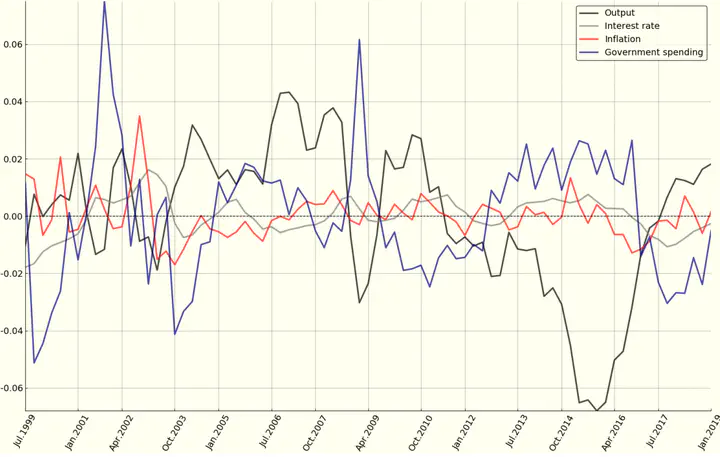

Time series - Brazilian data

Time series - Brazilian dataAbstract

This paper identifies the leadership structure of the game played by monetary and fiscal authorities in the Brazilian economy after the implementation of inflation targeting regime in 1999. A stylized small-scale New Keynesian model augmented with fiscal policy is estimated using Bayesian methods. I assume that monetary and fiscal authorities can act strategically under discretion in a non-cooperative setup and compare three different forms of games (i) simultaneous move; (ii) fiscal leadership; and (iii) monetary leadership. I find strong empirical support for the hypothesis that the Brazilian fiscal authority acts as a Stackelberg leader. The results obtained can shed some light on the improvement of policy design in the Brazilian economy.

Status

Submitted to Revista Brasileira de Economia - Brazilian Review of Economics